Taxes title license calculator

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive. The monthyear the registration will expire for the buyer.

How To Calculate Tax Title And License In Texas Calculating Taxes On Newly Bought Cars

Remember that the total amount you pay for a car out the door price not only includes sales tax but also registration and dealership fees.

. The sales tax on both new and used vehicles is calculated by multiplying the cost of the vehicle by 625 percentage. New Mexico Title Only. How to Calculate Kentucky Sales Tax on a Car.

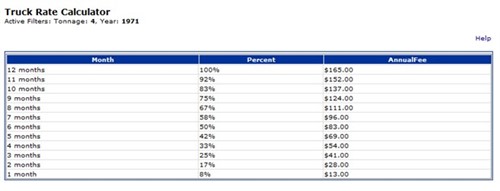

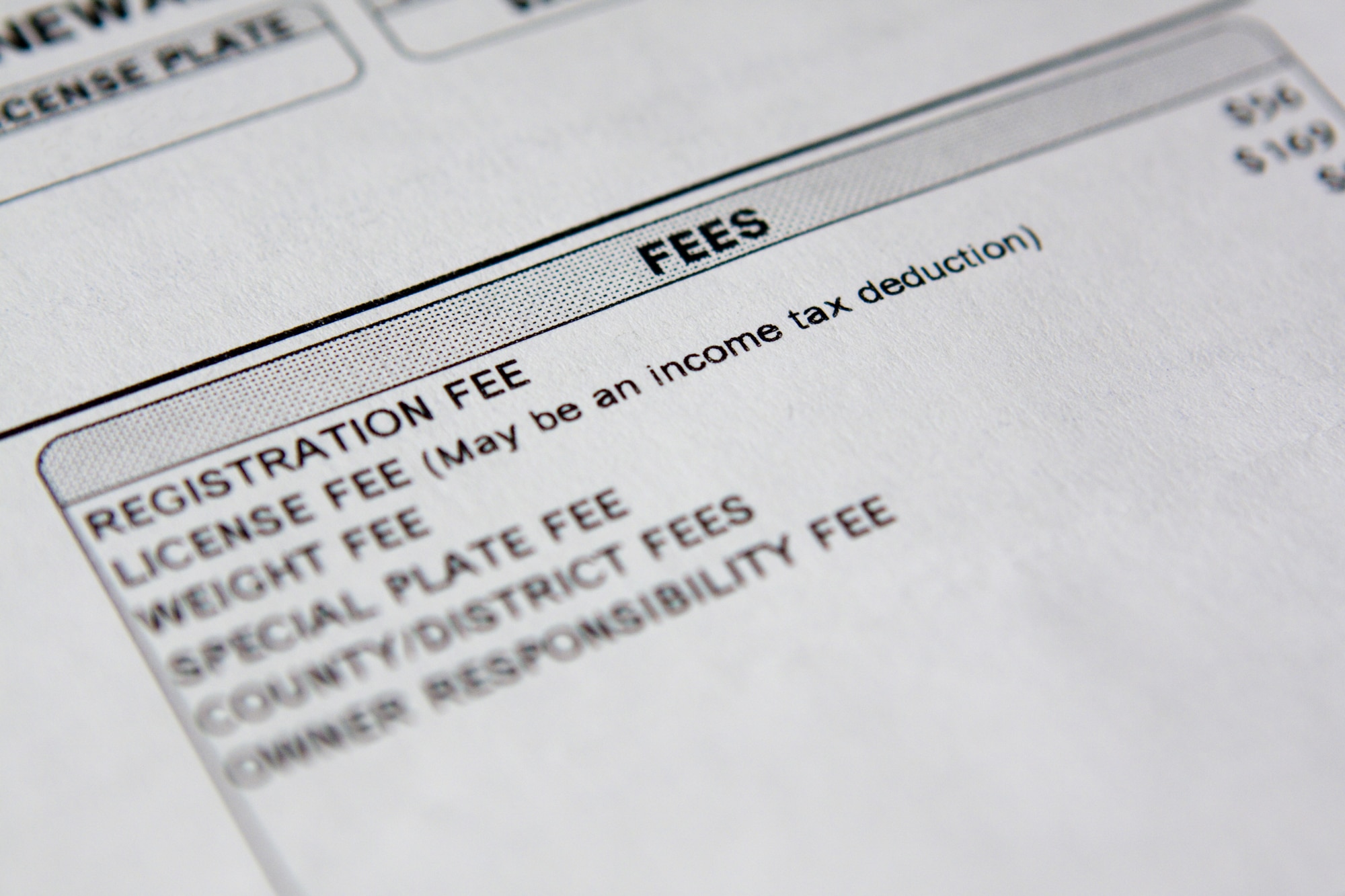

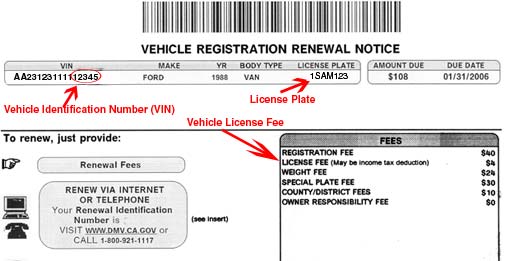

Pick the number of liens that will be recorded on the title. State excise tax 25 for each 1000 of the cars value The vehicles value is a percentage of the manufacturers list price in the year it was manufactured. 1500 - Registration fee for passenger and leased vehicles.

Calculator by Chicago Title. Vehicle License Fee VLF paid for tax purposes Select a Calculator to Begin Registration renewal fees Registration fees for new vehicles that will be purchased in California from a licensed. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

How are tax title and fees calculated. The minimum is 625 in Texas. To drive in Massachusetts a vehicle and trailer needs to be properly registered with the RMV and the vehicle owner must have a legally acquired title.

Multiply the vehicle price after trade-in andor incentives by the sales tax fee. In Texas the title fee is 33 in most of the counties. Title.

Individual Income Tax Calculator. In most counties in Texas the title fee is around 33. The charges quoted on this web site are estimates only and should not be relied on as accurately reflecting the charges for a specific transaction.

Child Support Lien List. The Registration Fees are assessed. Registration fee for commercial truck and truck tractors is based upon the gross.

Taxes title license calculator Rabu 21 September 2022 The sales tax on both new and used vehicles is calculated by multiplying the cost of the vehicle by 625 percentage. For example if the total of state county and local taxes was 8 percent and the. Summary Vehicle Price 25000 Down Payment - 2500 Est.

The max is 3. Car payment calculator APR Estimated based on your credit score. Register and Title Your Vehicle.

Multiply the sales tax rate by your taxable purchase price. Tax Title FeesCurrently Unavailable Total 22500. For the sales tax of both new and used vehicles to be paid it is calculated by multiplying the cost of buying the car by 625.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Solution A Car Costs 25 000 Plus 675 For Tax Title And License Fees Ari Finances The Car By Putting Down 2 500 In Cash And Taking Out A 3 Year 4 Loan What Will His Monthly Payments

Massachusetts Used Car Sales Tax Fees

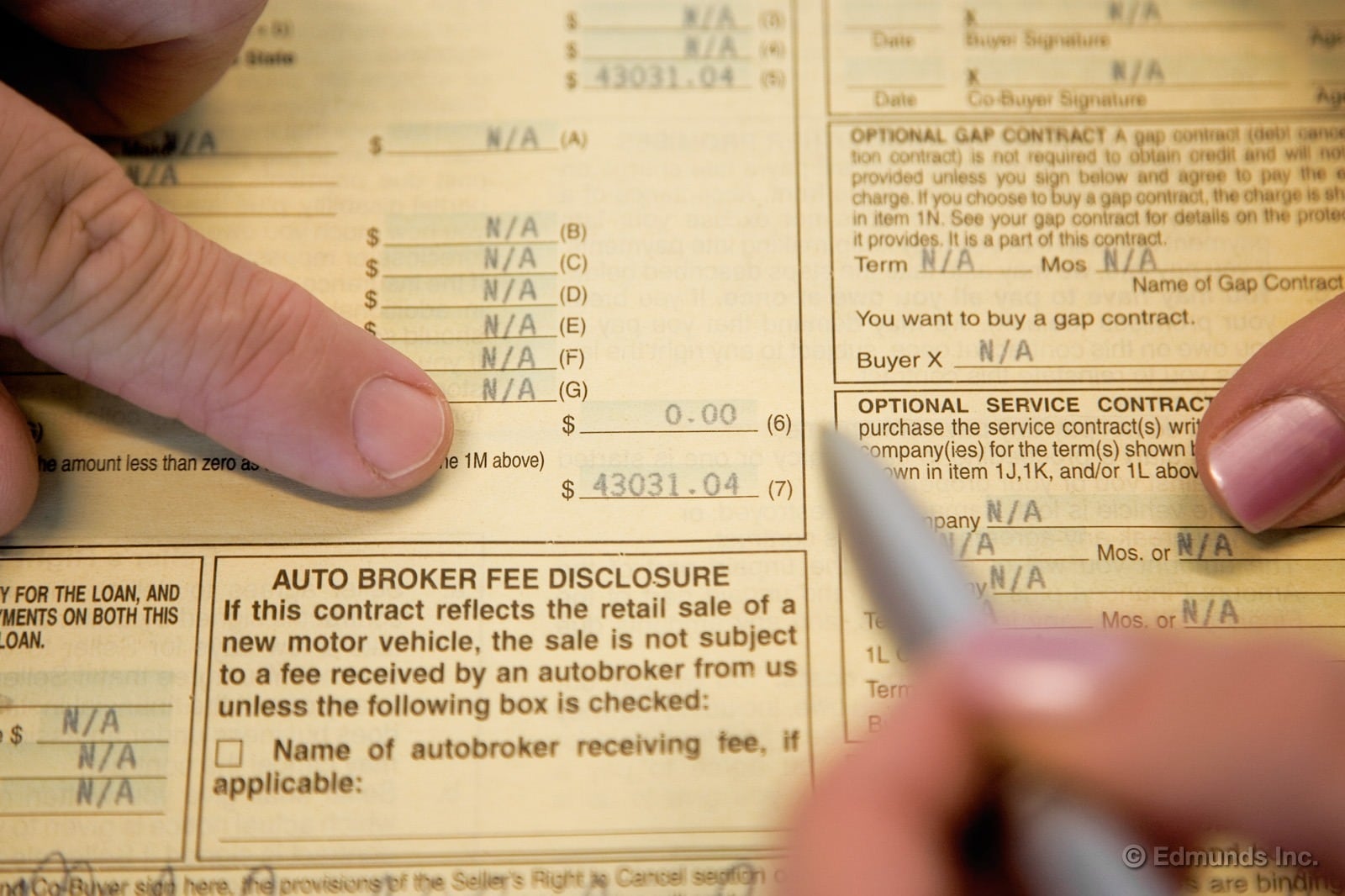

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

What Is A Car Registration Fee Capital One Auto Navigator

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Car Payments Calculator Car Affordability Calculator Nadaguides

Vehicle Registration Licensing Fee Calculators California Dmv

A Primer On The Vehicle License Fee

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Vehicle Registration Licensing Fee Calculators California Dmv

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Car Tax By State Usa Manual Car Sales Tax Calculator

How Much Does Tax Title And License Cost

Dmv Fees By State Usa Manual Car Registration Calculator